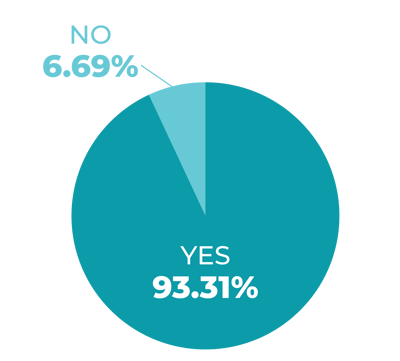

Past-due customer satisfaction matters. Why? Because unhappy customers don’t remain customers for long. In the first quarter of 2020, we surveyed more than 2,000 Canadians to better understand past-due customer habits and preferences. Of our respondents, nine out of ten said an unpleasant collection experience made them consider changing suppliers.

Did this bad experience make you consider switching to a competitor?

© 2020 Lexop, Canadians Repayment Preferences Survey

This statistic poses a challenge for companies in industries with low switching costs, such as telecommunications and financial services. If customers can easily defect to the competition, how do you get them to stay? Thankfully, we’ve figured out the secret to creating a positive past-due experience that retains customers.

What makes a satisfied past-due customer?

Our respondents who recently went through collections were evenly divided on the topic of customer satisfaction: half had a positive experience (51%) while half did not (49%). So, we asked both groups to name the most critical factor determining which camp they fell into.

Among satisfied customers, 37% told us that the option to create a payment agreement was the primary reason for their positive experience. Another 37% responded that the contact method used to notify them was most important.

However, of those who were dissatisfied, 79% said their negative experience was due to a lack of payment agreement options.

The risks of a bad collection experience

The survey makes it clear: flexible payment options and preferred contact methods are vital in creating positive past-due experiences. These services are usually available to regular customers, but when a bill goes to collections, everything changes. Convenient payment portals are no longer accessible, and emails are replaced by telephone calls and impersonal letters.

We call this rapid change the blind spot in your customer journey—the stage at which preferred online services are supplanted by an alienating, frustrating collection process. The blind spot makes customers feel undervalued, or worse, harassed. And as we know, bad past-due experiences increase your risk of losing clients altogether.

Improving the collection process

Every touchpoint counts when it comes to customer retention—including when dealing with late payments. So, when bills go unpaid, how do you ensure your customers have positive past-due experiences?

First, you should adapt to their preferred communication methods. Our survey found that 87% of respondents were recently notified about a late payment via an offline method—yet 54% want to be contacted online.

Next, you should offer the payment methods customers are asking for. Sixty-four percent of respondents told us they recently had to use an offline method to pay a past-due bill—but 77% would have preferred to make a digital payment. In our 2021 Consumer Repayment Preferences Survey, the same percentage of respondents (77%), stated they prefer to make payments digitally.

Finally, let your customers create flexible payment agreements. These arrangements are rarely available in collections, but they’re among the most critical factors determining past-due satisfaction.

Your digital collection strategy

Switching to preferred communication and payment methods is the perfect recipe for a positive collection experience. And the one thing these methods have in common? They all take place online. Clearly, digitizing your collection process is a sure-fire way to improve customer satisfaction. By providing a positive past-due experience, you retain more customers and eliminate the blind spot in their journey.

Editor's Note: This post was originally published in May 2020 and has been updated and for freshness, accuracy, and comprehensiveness.