Customer-centric collections is essential to create a seamless and cohesive customer journey. Here’s why.

While best practices abound, technologies evolve and business trends shift, leaders who put customer experience front and center understand one thing: customers want the same thing they’ve always wanted – to be taken care of.

Technology sets the bar higher and higher for convenience and speed. But at their core, expectations remain the same. Customers want a reliable way to connect, they want to be listened to, they want empathy.

This back to basics mindset is the starting point for collection teams to become customer-centric.

Collections used to be a segregated function. It focused exclusively on bringing delinquent accounts current while remaining out of touch from customer experience concerns. The shift to a customer-centric approach frames collections differently. From a sliver relegated to the end of the value chain, collections become an integral part of an otherwise incomplete customer journey.

What does customer-centric mean?

Customer-centricity can be summed up in 3 directives:

-

- Provide stellar customer service from initial contact to purchase – and even beyond the point of purchase.

- Embed the customer’s needs and future wants in every single interaction.

- Sales, credit, collections, customer service, and all other functions work as one to meet the customers’ needs.

Under the guidance of these rules, customer service becomes a core value shared by their entire team. Customer feedback is regularly collected, incentives are tied to customer service metrics, and resources are readily available for customers to find answers on their own.

This philosophy is especially relevant to businesses with low switching barriers such as internet/phone providers. When customers can easily cancel their plans and switch to a competitor, companies need to go above and beyond to stand out from the competition.

How Millennials are redefining “customer-centricity”

In 2020, Millennials are the biggest demographic cohort in Canada – and the one with the most buying power. Any definition of customer-centricity and any customer experience initiative will be heavily molded by the new dynamics that they bring. This tech-savvy generation brings a host of new variables:

-

- They aren’t as brand loyal as the older generations.

- They care about convenience above all else.

- They have different payment and contact method preferences.

In 2019, Lexop ran a country-wide survey which revealed that 58% of Millenials/Gen Z prefer to be reached via digital contact about a past-due bill. Moreover, 68% of them prefer to pay online.

McKinsey ran a survey that confirmed these findings. Their research also revealed a glaring mismatch between the contact method lenders were using and what customers preferred. A whopping 65% of contact to past-due customers is done through traditional channels (phone, voice mail, letter) despite poor response rates. This is standard practice even though digital contact methods outperform their traditional counterparts by a wide margin.

‘‘89-92% payment rates can be achieved by using digital channels – online banking and mobile.”

– McKinsey, 2019

While the companies surveyed by McKinsey do use digital contact channels such as email and text messaging in early delinquency, they revert to phone calls and letters once accounts hit the 30-day mark. Contrary to conventional wisdom, McKinsey’s research revealed that the effectiveness of digital contact applies to every stage of delinquency – even over 30 days past due.

Verdict: There’s a misalignment between collection strategies and customers’ preferred contact channels. Companies are weighted down by suboptimal payment rates. To correct this, contact methods such as email and SMS should be prioritized at every delinquency stage.

Here's the missing piece to make your customer journey whole

Today’s customers expect everything at their fingertips; buying on Amazon, getting a ride on Uber, ordering on Foodora, etc. Savvy companies are catching on. Here are a few examples of customer experience innovations by industry:

-

- Telcos: Omnichannel support, upgraded monitoring systems, and predictive analytics.

- Utilities: Online billing, real-time utility usage, and outage alerts.

- Lenders: AI-powered chatbot, biometrics, and voice-activated banking.

- Insurance: Mobile FNOL, pay-as-you-go, and online quotes.

Business leaders are making progress in creating a cohesive and seamless customer experience. However, one flagrant blind spot remains:

How past-due customers are treated.

The blind spot in your customer journey

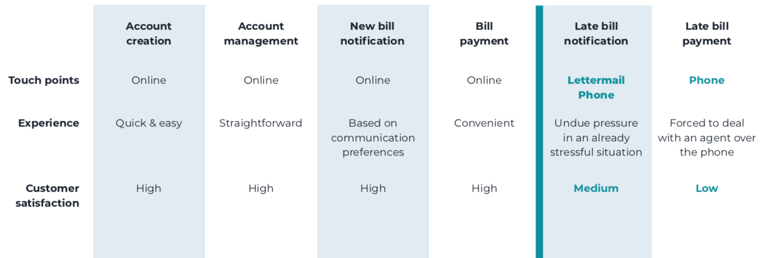

While paying customers can sign in online, make account changes online, pay online – past-due customers are left on their own. The status quo is to have them call a 1-800 number. They are then faced with the prospect of waiting in a queue and haggling with an agent. Even worse, customers are swarmed by generic letters in their mailboxes and coming home to automated phone calls prompting them to pay their late bills.

In a nutshell, they are cut out of an otherwise complete customer journey. They do not have access to the same tools and are not experiencing the same level of care. This fracture in the customer journey is ruining companies’ chances of collecting fast without permanently damaging the customer experience.

What can business leaders do to rectify this?

Here is a 4-step plan to transform your collection journey:

Step 1 – Deploy a multi-channel contact strategy

It all starts with putting a greater emphasis on digital contact methods. As previously stated, digital channels are widely preferred among past-due customers. They outperform their traditional counterparts when it comes to payment rates at every stage of delinquency.

For optimal results, no channel should be used alone. Email, SMS, and mobile apps should work in sync as part of a sequence. The end goal is to coordinate a series of email notifications and SMS reminders. This sequence should be continuously iterated to maximize contact and payment rates.

Step 2 – Invest in self-service payment

Self-service is a hallmark of customer-centricity. According to The Effortless Experience, customer service interactions are four times more likely to lead to disloyalty than to loyalty. The takeaway is simple: customers would prefer to find solutions to their problems themselves, rather than talk to customer service. In the same way, customers expect to pay on their own terms, without being forced to call a collection agent. Providing them access to a self-service payment portal gives them that option.

Moreover, according to Gartner, “By 2020, customers will manage 85% of their relationship with the enterprise without interacting with a human.” In this environment, investing in self-service is no longer a matter of future-proofing, it’s ubiquitous and expected. Also, providing customers with the means to self-cure takes the load off your collection/customer service team who are now free to focus on high-care accounts.

Step 3 – Tailor your messaging

Past-due customers are facing a stressful and often embarrassing situation. Companies who are sending the same overused, generic collection notices are doing themselves a disservice. Different people respond to different cues, messages, and tones. Instead, adopt a more nuanced approach. Craft your messages with a more empathetic tone and customized according to customer segments and responsiveness.

Messaging also goes beyond just words. The design language of everything you’re sending out in the world, including late payment notices are an essential element to build trust. Make sure to adopt a consistent design across email, SMS, and payment portal. Include your brand colors and logo to remove suspicions of spamming or phishing.

Step 4 – Improve your outreach campaigns through analytics

Without tracking your customer’s behavior in real-time, your collection process remains static. Your team has no way to understand customers’ reasons for late payment and fine-tune their outreach campaigns.

Empowered with the right behavioral data, you could identify optimal communication templates, pinpoint the best time and channel to reach customers, and derive their likelihood of payment. In other words, implementing the right tool to track and analyze data provides you with actionable insights. You can then use these insights to hone your collection process and improve contact and payment rates.