In the first quarter of 2020, we reached out to more than 2,200 Canadians to determine the habits and preferences of past-due customers. Our aim, among others, was to learn more about communication methods currently used in the collection process. What channels do companies rely on? And which do Canadians prefer?

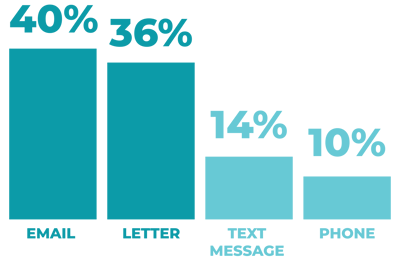

The results were clear. When we asked our all-ages pool how they prefer to be notified about past-due bills, the most popular answer was email, accounting for nearly 40% of responses.

Ideally, how would you prefer to be notified about a past-due bill?

© 2020 Lexop, Canadians Repayment Preferences Survey

Why email?

The most common reason our respondents gave for favoring email was accessibility. Many of those surveyed explained that they “already check email several times a day,” so receiving past-due notifications in their inboxes simply makes the most sense. Additionally, email can be accessed from multiple devices, anywhere, at any time.

‘‘My email is one of the few things I check on a daily basis, so it is likely the quickest/easiest way to get my attention when needed.” – Alyssa F.

Another popular reason was convenience. Email is instantaneous and easy to manage, and many people already organize their bills digitally. As one respondent put it, “Everything is online nowadays.”

‘‘There are many reasons to prefer email. Emails are timely, with no delay whatsoever, so the content is accurate. I check my email very often, so I am informed of the collection issue immediately, due to other matters. Emails are basically free, no postage is required. In foreign countries, I use free WiFi, reading my emails on vacation. I cannot use my telephone and I get no postal mail while on vacation.” – Rodney H. N.

Other respondents cited email’s non-intrusiveness. Compared to a phone call, email is less confrontational and less likely to cause undue anxiety, stress, and embarrassment. It’s also reliable, confidential, and easy to identify as fraudulent.

‘‘I think it's just easier through email only because of all the scams that are going around it makes it easier to see if the emails are legit. A lot of people opt-in for emails cause most of us work so answering our phones during work hours are a big NO, unless you know who's calling. (i.e.: child's school, doctors, etc.) Plus, if I don't recognize a number I won't answer anyway.” – Cynthia L.

The unadapted current practice

Past-due customers might prefer email, but our survey reveals they’re still mostly being contacted by traditional means.

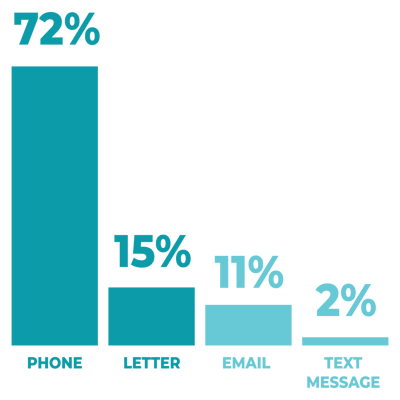

In fact, 72% of respondents said telephone calls were the most common contact method used for past-due payments. In contrast, only 10% of the respondents named phone calls as their contact method of choice. According to our pool, phone calls are inconvenient, intrusive, and can easily be perceived as scams.

What has been the most common contact method used to notify you about a past-due payment?

© 2020 Lexop, Canadians Repayment Preferences Survey

Respondents had similar qualms regarding traditional mail, which ranked in our survey as the second most common contact method used (15%). They cited, among other inconveniences, how easily letters can be delayed, lost, or misplaced.

Moreover, today’s customers have sustainability top of mind. Several respondents noted that traditional mail is not environmentally friendly, suggesting that paperless communications are the way to go.

‘‘Phone calls are perceived too easily as a scam and aren't answered. Letter mail takes longer than an email and is less environmentally friendly.” – Mark G.

So why, then, do phone and paper communications remain so prominent? It seems most companies still hold firm to the belief that traditional channels are most effective when it comes to unpaid accounts. Is there any weight to this belief? Or, could adapting to customer preferences actually be in your company’s best interest?

Digital communication for effective collections

It turns out that email notifications aren’t just what your customers want—they also increase your recovery rates.

According to a recent McKinsey survey of credit card debtors, digital contact methods outperform their traditional counterparts at every stage of delinquency. The study shows that when a company continues to use digital channels after the 30-day mark, the number of full and partial payments is 12% higher than if they had switched to traditional methods.

The bottom line? Digital channels such as email generate better results than traditional contact methods. As such, switching to email notifications instead of old-fashioned letters and unwelcome phone calls is one of the quickest ways to upgrade your collection process.