Recently, we posted an article about past-due customers and email communications. In it, we cited our recent survey of more than 2,000 Canadians, which we conducted in the first quarter of 2020. One of the most striking discoveries was the significant gap between what customers want and what they’re actually getting. While most respondents favor an easy, online customer journey, many companies—to their own detriment—persist with traditional collection strategies.

According to the same survey, such a gap also exists between the payment methods offered to past-due customers and the methods they wish to use. The numbers show that most past-due customers value autonomy and flexibility. Nevertheless, the payment framework they’re confronted with is overly rigid and, quite frankly, outdated. It’s a fissure that may be holding back your collection process. Let’s dive into the data to find out why.

What customers want…and what they’re getting

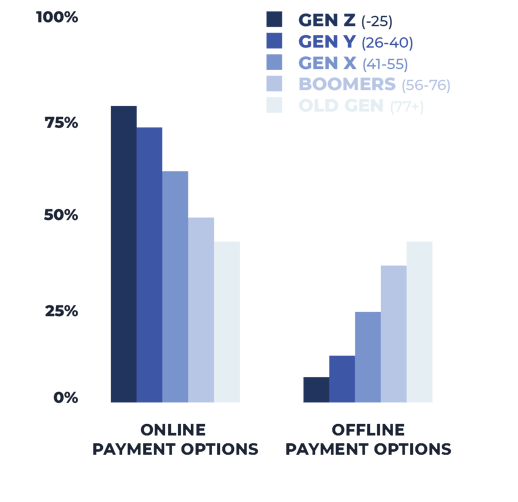

Of our respondents, 77% told us they prefer to pay past-due accounts online (either by credit card, bank transfer, or self-service portal). It’s worth mentioning that this preference for online payment applies to all generations, even seniors.

Ideally, what would be the perfect way for you to pay a past-due bill?

© 2020 Lexop, Canadians Repayment Preferences Survey

Additionally, 77% indicated they would rather use a self-service portal than being forced to call a customer service agent. Clients want to pay online, and they want to pay autonomously.

Moreover, among those who had a positive past-due experience, payment arrangements ranked as the main factor for their satisfaction at 37%. Another 16% indicated that having multiple payment methods available was most important to them—flexibility matters.

However, these types of online, flexible, self-service options are surprisingly uncommon. We found that 64% of Canadians who recently made a late payment used an offline method to do so. Shockingly, almost half of respondents (47%) had to physically go to the bank—a far stretch from settling their bills with a few finger taps.

Why past-due experiences matter

Online portals and payment flexibility don’t just make customers happy; they’re also good for business. These assets are deciding factors in whether a customer has a positive or negative customer journey. Simply put, they impact retention rates.

When asked what contributed to a negative past-due experience, respondents overwhelmingly cited a lack of flexible payment arrangements as their main turn-off (79%). Another 8% were disappointed by the payment methods available.

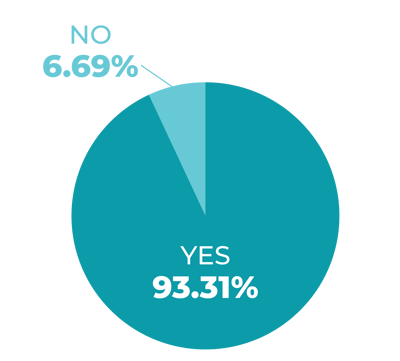

A bad past-due experience can irreparably harm a customer’s relationship with your company. In fact, nine out of ten respondents said a bad collection experience made them consider switching to another company. This statistic should ring alarm bells for businesses in industries with low switching costs, such as telecommunications and financial services.

Did this bad experience make you consider switching to a competitor?

© 2020 Lexop, Canadians Repayment Preferences Survey

A system that works for everyone

Flexible, online payment options aren’t just great at reducing churn—they also increase recovery rates by encouraging self-cure.

Our survey revealed that many customers would self-cure if given the opportunity. When asked why they were late to make a payment, almost 60% of respondents cited reasons totally unrelated to financial difficulties. The most frequent response, totaling 37% of those surveyed, was a lack of flexible payment options. It’s not that they’re unable to pay; they simply wish to pay on their own terms.

Kickstart your new collection process

The results are clear: an online portal that lets customers arrange their own payment parameters significantly increases the likelihood of receiving full and partial payments.