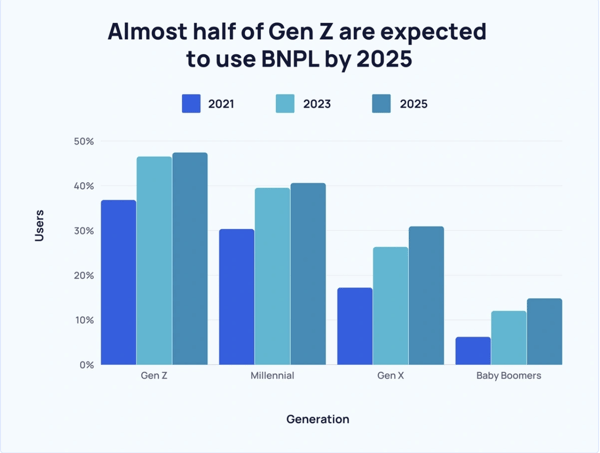

With inflation remaining high and consumers turning to alternative credit for purchases, the BNPL industry is booming and experiencing rapid growth. Growing up in the digital era and frequently shopping through their mobile devices, Gen Z and Millennials make up the majority of BNPL users, and adoption rates among Gen Z are expected to increase from 36.8% in 2021 to 47.4% in 2025.

Image source: https://explodingtopics.com/blog/bnpl-stats#general-bnpl-stats

In 2022, there were an estimated 360 million people worldwide using BNPL services, and these numbers are set to more than double over the next five years. By 2027, it's expected that there will be 900 million BNPL users.

More BNPL users = more BNPL loan issues.

The Consumer Financial Protection Bureau (CFPB) published a report in September 2022 stating that from 2019 to 2021, the number of BNPL loans originated in the U.S. by the five lenders it surveyed grew from 16.8 million to 180 million.

As the demand for BNPL grows, what does this surge in popularity mean for consumers, and how does this increase impact collections for lenders and BNPL providers?

In this blog, we'll discuss why BNPL is a fast-growing market, the behaviors of BNPL borrowers, the impact on collections, and how to bridge the technology gap between loan originations and collections.

Why is BNPL on the rise?

One of the key drivers behind the rise of BNPL is the shift towards a more customer-centric approach to retail, especially as the pandemic shifted shopping habits online. With BNPL, consumers can complete their purchases quickly and easily without worrying about the upfront cost of the product.

Big players like Affirm, Afterpay, Klarna, and now Apple Pay Later, one of the newest in the market, are making their presence known in every e-commerce corner and offering a convenient, frictionless payment shopping experience. Retailers are increasingly partnering with BNPL providers to attract and retain customers, which is helping to fuel the growth of the BNPL industry.

Additionally, some BNPL services have bundled perks, such as high loan limits and no late payment fees into their loans, making their services even more enticing to consumers.

BNPL consumer behavior

Previous studies showed that consumers were using BNPL because of the lack of access to credit. However, the newest CFPB report, "Consumer Use of Buy Now, Pay Later," highlights that BNPL borrowers are accessing other credit products and frequently use them.

To gain a better understanding of BNPL consumer habits, here are some interesting data points from the report:

- 95% “had at least one credit record in another account, compared to the 86% non-borrowers.”

- 88% also had a credit card - and they were 27% more likely than non-users to carry a balance and accrue interest.

- 69% said they carried a balance on at least one credit card.

- BNPL borrowers had lower credit scores (580-669), while non-borrowers had an average (670-739) score.

How does BNPL impact collections?

The ease, convenience, and flexibility of BNPL appeal to consumers, but it can also negatively impact collections. Within the CFPB survey, 25% of BNPL users didn’t have any emergency savings or other savings unrelated to retirement. Additionally, about half of BNPL borrowers had less cash and savings than what they paid for the BNPL purchases.

As we see the number of BNPL loans growing and consumers actively using other credit products in tandem with BNPL, it can become more challenging for them to manage multiple debts. BNPL borrowers were more than twice as likely to be delinquent on at least one of their other credit or retail card products by 30 days or longer compared to non-borrowers.

18% of BNPL borrowers had at least one reported delinquency in another account, compared to 7% of non-borrowers. Delinquency rates were substantially higher for credit (9%) and retail cards (8%) among BNPL compared to non-borrowers (3% and 1%, respectively).

But delinquencies are not just happening within other credit products. Affirm reported in September 2022 that its 30-day delinquency rates, ex-Pay in 4, were 2.7%, up from 1.5% from the same quarter ending in September last year and up from 0.8% in 2021. Naturally, as the BNPL industry grows, there is a rise in delinquencies within the market, and inflation is hitting Americans most likely to use these services the hardest.

How to bridge the technology gap between origination and collections

BNPL services have a sophisticated acquisition and onboarding process for their customers, but we’re not seeing that same simple, digital, fiction-free process for collecting the money owed.

The repayment experience is often fragmented. We can’t expect BNPL borrowers to respond to traditional collection methods like unsolicited phone calls, creditor letters, and rigid payment schedules that are disjointed from the digital loan origination process. Let’s not forget that BNPL services are most popular among Gen Z and Millennials, who want self-service payment tools.

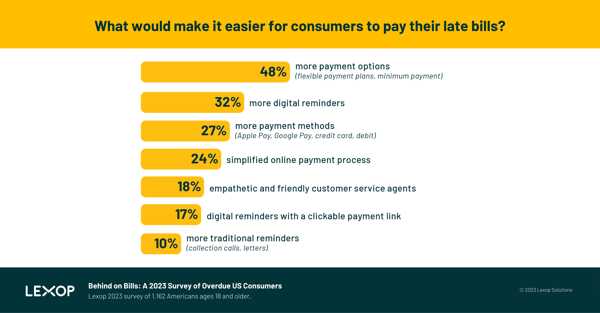

Lexop recently released a report with the findings from a survey we conducted on the behavior of past-due consumers in the U.S. to gain insights into their financial state, how they want to be reminded about late bills, and what would make it easier to pay them. 73% of respondents said a digital repayment experience would make paying late bills easier. More specifically, these digital tools would help them pay their late bills:

- 32% - digital reminders

- 24% - simplified online payment process

- 18% - empathetic and friendly customer service agents

- 17% - digital reminders with a clickable payment link

Only 10% said that traditional reminders would be helpful.

As competition strengthens in this market, especially with Apple Pay Later launching, providing a seamless collection experience is essential for customer satisfaction and retention. Inflexible repayment schedules and poor agent interaction from 3rd party collectors can impact customer experience and dictate whether they continue to use these BNPL services.

Here are some strategies to consider to bridge the gap in collections:

- Provide a self-service repayment experience with flexible payment terms and payment options.

- Make empathy and customer satisfaction a priority within the repayment experience.

- Adopt a digital-first approach considering Gen Z and Millennials comprise the largest customer demographic.

- Leverage automation for more efficient outreach with rising delinquencies.

Providing the same level of sophistication for collections as loan originations, with a seamless digital, self-service payment experience can result in a win-win for both BNPL providers and their customers.