The beginning of holiday shopping is upon us. For many, this festive time of year can be highly stressful and challenging, with increased spending on travel, gifts, and hosting expenses.

As it stands with holiday gifts, even with inflation challenges, 74% of Americans still plan to spend the same or more on holiday gifts this year, according to a Shopify-Gallup survey.

This overspending is especially concerning, with US credit card debt hitting a record $1.08 trillion.

Here are some quick holiday shopping stats:

.png?width=820&height=312&name=31%25%20of%20Americans%20are%20still%20paying%20off%20last%20year%E2%80%99s%20holiday%20debt%20(1).png)

- 52% of consumers incurred credit card debt from last year's holiday shopping

- Of that 52%, 31% still carry over a credit card balance

- Consumers plan to charge their credit card with an average of $680

- 27% say they'll probably go into more debt than usual to purchase gifts this year

According to the survey, 5% of 2023 holiday shoppers say they’ll go into debt using BNPL services to buy holiday gifts this year.

As a credit union, understanding how to build a focused and empathetic collections strategy will be especially important when engaging with your financially-strained members this time of year. Here are five collection strategies to help you navigate consumer debt this holiday season.

1. Prioritize the Member Experience

Banking with a credit union offers members an experience marked by a strong sense of community, individualized care, and a dedication to financial prosperity, promoting a member-centric approach.

In a time when financial stress is at its peak, collections teams should offer support and empathy to strengthen the member relationship further. Adapt the collections process as needed to ensure you meet members where they are at and support them through any financial hardship.

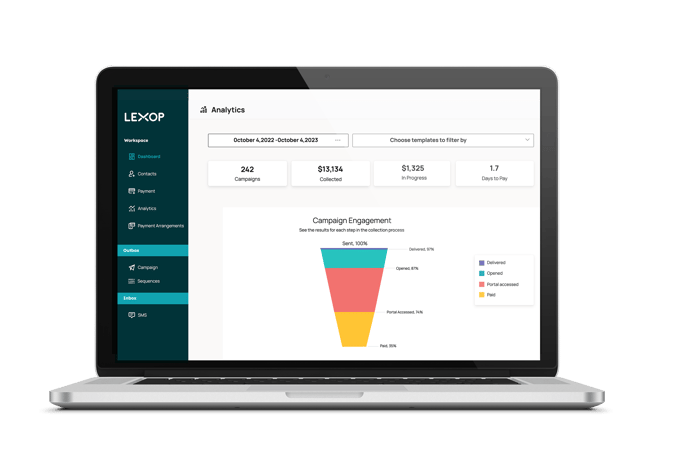

Reach members with the right message in the preferred communication channel and at the right time. Utilize data analytics that help you pinpoint the optimal time to send out late payment reminders can help you discover the ideal time to send out notifications.

2. Send Frequent, Segmented Automated Reminders

It's easy for consumers to lose track of how much debt they've accumulated with their holiday spending, as this is often a time of year when people spend mindlessly.

Digital reminders are a great way to spare the embarrassment of collection calls while hosting holiday guests.

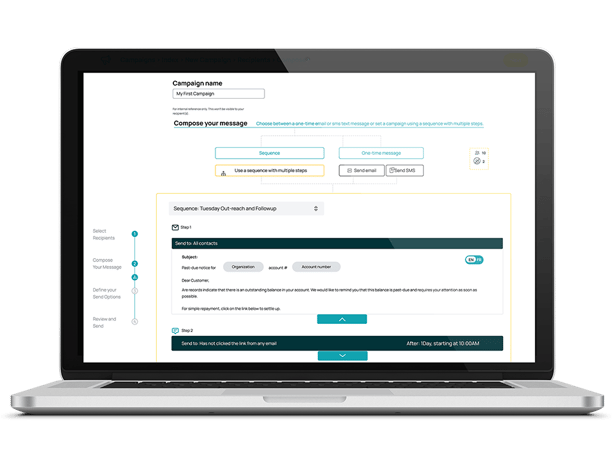

Consider sending automated reminders through text messages and email before their payment due date to set them up for success and give your members a chance to save money before their payment is due. Automation allows multiple touch points from early to mid-stage collection and will free up your collections team's time so they can focus on the higher-risk accounts that require more personalized attention.

Also, keep in mind that a member who is only a few days late should receive a different message than one several months late.

3. Deliver Empathetic Communication

The definition of empathy is the ability to understand and share the feelings of another person.

The holiday season can be difficult for many consumers, especially for the 52% of consumers who are already carrying high debt levels before going into the holidays.

Designing an empathetic approach doesn't just mean listening to how your members feel; it also means communicating in their preferred channels, assessing their unique financial situation and ability to repay, and providing options that suit their needs. This will help them feel in control of the repayment process.

Having an empathetic approach to collecting post-holiday debts will help your members feel more comfortable in the process and lead to a higher likelihood of them prioritizing the repayment of a particular bill.

4. Provide Flexible Payment Arrangements

With increased credit card spending, we know holiday shopping will put additional financial strain on consumers. Offering payment options and payment arrangements will help these members manage their payments and avoid debt piling up.

Consider working with members around timing and payment methods to mitigate the risk of failed payments from insufficient funds.

When you provide members with payment flexibility, you help establish a commitment to your member's financial well-being, further building member trust and loyalty.

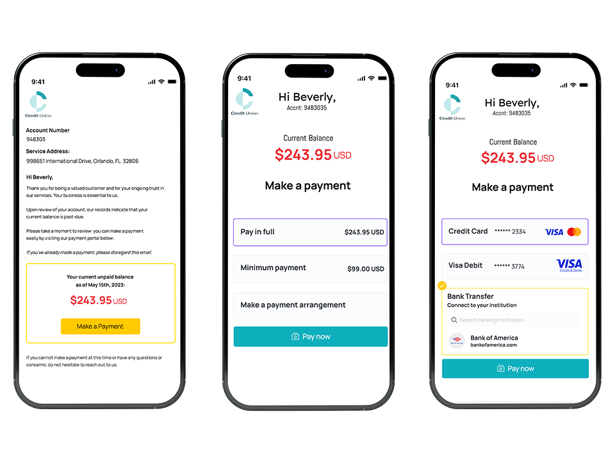

5. Offer Self-Service Payment

The ease of payment is integral in resolving late payments. If it's difficult or inconvenient for your members to make payments, the friction can lead to drop-off points in the repayment process. The key is to provide a seamless repayment experience, requiring your members to take as few steps and clicks as possible to resolve payment.

3 Clicks to Resolve Payment

Simplify the process by allowing your members to make payments directly within the email communication. Removing the embarrassment and allowing your members to self-cure without speaking to a call agent will create a better repayment experience.

“Customers don’t want to constantly explain why they are late on their payments, giving them the opportunity to self-cure is a win/win solution.” - Jahed Jahed, Vice President of Collections

As credit unions navigate the complexities of consumer debt this season, a member-focused collections strategy becomes paramount.

By prioritizing the member experience, employing empathetic communication, offering flexible payment arrangements, and integrating self-service payment options, credit unions can assist financially-stressed members, foster loyalty and improve satisfaction scores.

Amid the bustling holiday season, the combination of understanding, support, and strategic initiatives can make a significant difference in helping members navigate and overcome holiday debt.

Learn how you can get ahead of collecting holiday debt, without hurting the member experience. Experience Lexop for yourself. 👇

.png?width=575&name=Holiday%20Shopping%20(2).png)