Your collections strategy defines the tactics used to follow up with past-due accounts. It should align with business goals, such as reducing expenses, increasing customer retention, and avoiding agencies. Consumers are feeling the financial pressure as the cost of living increases. In the CNBC, Momentive Your Money Financial Confidence Survey, 58% of Americans stated they're now living paycheck to paycheck, and 70% said they feel stressed about their finances - mostly due to inflation and rising interest rates.

An ethical debt collection strategy is customer-centric and offers flexible payment options, guidance, and empathy. Explore the five elements of a successful, ethical collections strategy and learn how it benefits your business.

The benefits of an ethical collections strategy

An ethical early-stage collections strategy can improve your reputation with your customers. For starters, it aligns with your company's mission and values. This factor is critical considering that 71% of Salesforce survey respondents said they "pay more attention to companies' values" than in 2019. Likewise, 99% "believe companies need to improve their trustworthiness." A human-centric approach aligned to your values increases consumer trust and fosters deeper connections.

Optimizing your first-stage collections process can also boost customer satisfaction and retention. An ethical approach creates a partnership between your brand and customer, with both working towards a shared goal of resolving the past-due account. As a result, your business-client relationship improves, potentially leading to repeat sales. According to Salesforce, "53% of customers say they feel an emotional connection to the brands they buy from the most."

In addition, debt collection best practices help you achieve faster resolutions. By prioritizing early-stage collections, you can encourage clients to self-cure and allow them to interact with their account (and your company) on their terms. By giving customers the ability to pay late bills without agent intervention, you are freeing up time needed to work on more complex accounts - an important part of reducing operational expenses.

5 components of an ethical collections strategy

According to Capital One, 47% of survey respondents "are concerned about paying at least one bill in the next month." But, you don't have to choose between recovering revenue and your customers. Instead, you can remove friction and personalize your approach.

In short, by adjusting your strategy and intervening early, you can alleviate many problems associated with the past-due customer experience. Ready to humanize your past-due collections process? Here are five elements essential to an effective debt management and collections system.

1. Empathetic Communication

Consumers want companies to demonstrate empathy in all forms of communications, from marketing content to collection messaging. Additionally, Salesforce found that 66% of customers expect businesses "to understand their unique needs and expectations." Unfortunately, more than 67% of Lexop survey respondents said the agent they spoke with about an overdue bill wasn't empathetic or understanding of their situation. Many phone calls feel intrusive, and even though your employees may try to sound friendly, they can come off as unsympathetic.

Yet, 82% of Lexop respondents said they'd be "more likely to pay if the message was personal and understanding." Digital-first collections software helps you personalize email and text reminders based on your customer's preferences and past behavior. Your first interactions can be customer-centric and kind, so clients don't feel like you're encroaching on their private time.

2. Flexible Payment Options

As customers face financial issues, companies that offer flexibility can recover past-due bills quicker while reducing churn. Your clients want the option to make a payment arrangement or a minimum payment to stay on good terms with your company. Presenting customizable solutions instead of a one-size-fits-all approach can encourage customers to prioritize paying you.

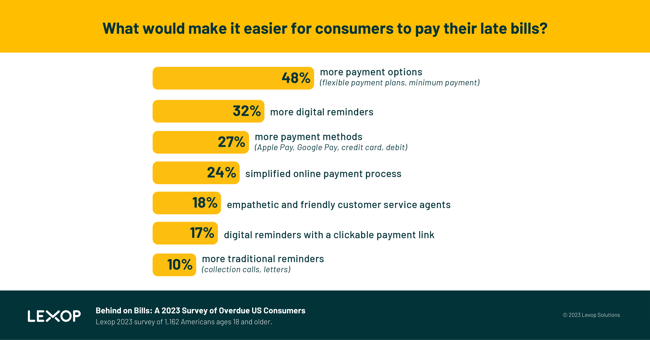

This flexibility should also extend to your payment methods. Your recovery tools should integrate with your preferred payment gateways, allowing customers to settle their accounts online. In our 2023 survey on past-due consumers, they responded that these tools would make it easier for them to pay their late bills:

- 48% - said more payment options

- 27% - said more payment methods

3. Digital Collections Process

Digitizing your collections process lets your customers have control over their accounts and the repayment process. Unlike phone calls that often catch clients at bad times, a 24/7 self-service online payment portal gives consumers access to account details and payment options on their terms. Additionally, an email or text message reminder can communicate your concerns without putting your clients on the spot.

According to a McKinsey study, people contacted via digital channels had higher rates of full and partial repayments. Only 12% made a full repayment for people contacted by phone, and 36% made a partial one. In comparison, 58% of customers reached via text made a partial repayment, and 19% repaid their overdue bills. Therefore, the best channels for debt collecting are those your customers prefer and support their desire for self-service.

4. Seamless Payment Experience

An ethical collection strategy is simple and convenient. It shouldn't make customers jump through hoops to schedule a payment or force them to use communication methods that they aren't comfortable with. Your payment collections software should provide an excellent user experience, with fewer steps to view and respond to account reminders. The right tools can empower customers to self-cure at their own pace.

By choosing a secure payment gateway for digital collections and offering a contactless repayment solution, you can improve their overall experience. Frictionless options make the experience positive and increase customer retention.

5. Evolve with Customer Expectations

Consumer behavior and preferences vary by demographics and other factors. Your digital collections process shouldn't be stagnant. Instead, evaluate what's working and look for ways to improve it. A humanized collections strategy uses metrics to analyze customer behavior, allowing your organization to adjust its approach.

You should consider exploring a cloud-based solution to reduce costs, scale and increase speed to market. Cloud-based collection software don't require on-site infrastructure and are easy to deploy. Top-rated platforms help you track data and uncover insights without hiring a data analyst. Explore more tips in our guide to buying collections and recovery software.

Build your ethical collection strategy

Personalize your process for a customer-centric approach to past-due bills. You can reduce your operating expenses and increase productivity while resolving more early-stage, low-risk accounts. At Lexop, we know that you want to take a humane approach to collections. Talk with an expert to learn how our software can help you start collecting humanely.