Tax season is underway and so far this year, the IRS has reported that incoming tax returns are lagging behind the previous year, with a decrease of 5.7% in total returns received and a 6% decrease in returns processed.

While the total number of refunds and the total refunded amount have both decreased by almost one quarter, the average refund amount has risen by 2.1% compared to last year, averaging $3,207.

In a Bankrate.com survey, when Americans were asked about their plans for their refund, paying off debt (19%) ranked as the second most common response after saving.

As many consumers look to use their return to pay down debt, the question is - who will they pay first? Taking advantage of consumers’ increase in liquid cash takes work but with the right collection strategy that focuses on these four things, you can be top of mind and simplify the repayment experience for your customers.

1. Focus on personalized and positive communication

Prioritizing personalized and positive communication during tax season can improve your chances of collecting outstanding debts as consumers choose who to pay first. Customers treated with respect and understanding are more likely to respond positively to collection efforts. Personalize your communication by addressing the customer by name and using their preferred communication method.

You can also leverage technology to automate tailored, empathetic communication that resonates with your customers. A personalized approach to communication can not only improve collection rates, but it can also strengthen your customer relationship and foster trust.

2. Prioritize early-stage communication

Early-stage communications are crucial to any collections strategy, especially during tax season as you want to reach and engage your customers before other creditors do. Instead of waiting for a customer to miss a payment, you should use proactive communication to remind customers of upcoming due dates and encourage timely payments.

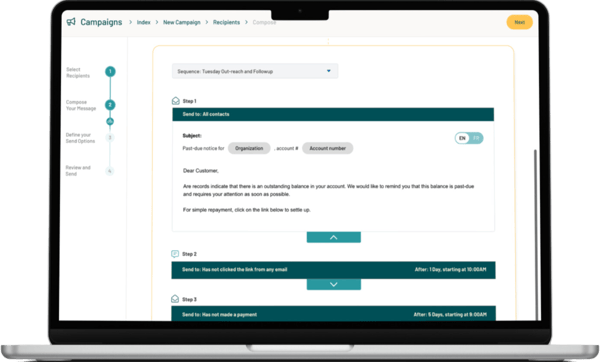

As the call volume increases during this busy time of year, it's difficult to scale without hiring more call agents. Our collection software has built-in automation for e-mail and SMS outreach to enhance your ability to reach more customers in the early-stage of collections and help them self-cure their past-due accounts. You can streamline your collection efforts and free up agent time for accounts that require more attention.

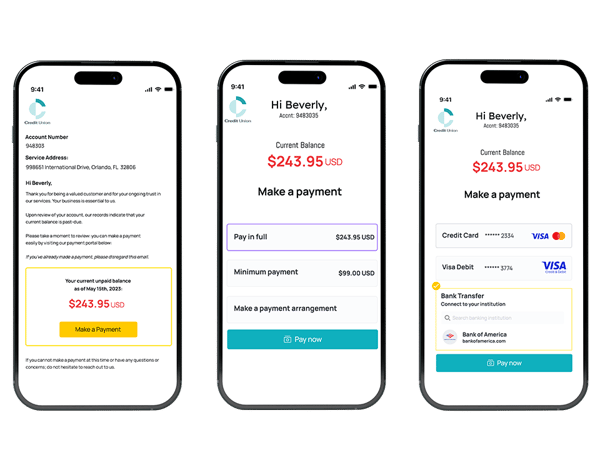

3. Provide a Simple Repayment Experience with Payment Flexibility

By making it easier to pay, you will increase your repayment success and collection rates. Offering flexible payment arrangements can be an effective way to improve collections.

While one-fifth of consumers plan to pay their debt with their return, a large population is still experiencing financial difficulties and needs help to resolve their debt. Offering flexible payment arrangements like a payment plan can help customers chip away at owed amounts over time. While this process may be slower, ultimately, it's better to collect some money than nothing.

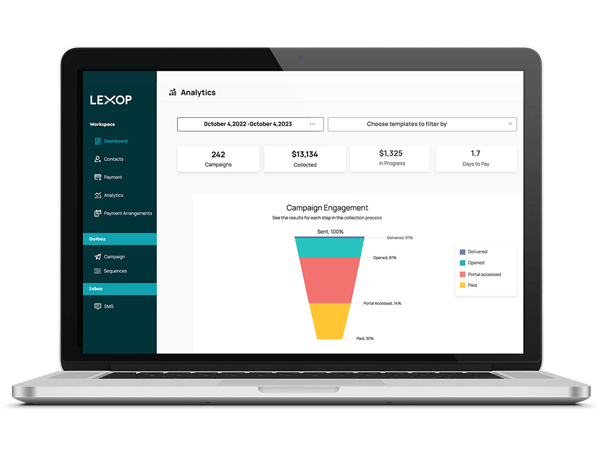

4. Leverage data analytics

Collecting and analyzing data can help you identify trends, risks, and opportunities. By reviewing past collection performance, you can identify areas of improvement and adjust your strategy accordingly. These insights can help your collection teams make smarter, more informed decisions to achiever greater collection success.

Additionally, data analytics can help you segment customers into groups based on their payment behavior and help your collections team prioritize collections efforts during the busy tax season.

Need help with your communication strategy? Steal these nine effective collection email templates that include early reminders, late notices, and legal action alerts to help your collection teams communicate effectively at every step.

.png?width=575&name=Tax%20Season%20Blog%20Header%20(1).png)