The challenge of shortened attention spans, rising delinquencies, and increased competition in the financial sector underscores the importance of seamless banking experiences, especially as there are fewer barriers to switching.

The financial institutions that can come out on top are the ones who have the best understanding of what their customers want, which leads us to the most important question: Do you really know what your customers want in their bill payments and digital services?

In the "Clicks, Taps, and Texts: Decoding Consumer Preferences in Digital Banking and Bill Payments" report, we surveyed 1,400 U.S. adults to uncover current trends in digital banking and bill payments that will help you audit how you are engaging with your current customers and explore new opportunities to provide a better banking experience.

We designed this survey to help financial institutions deliver solutions and services that match consumer preferences and value drivers.

Let’s start by digging into consumer preferences.

Consumer Banking & Bill Payment Preferences

We wanted to gain a deeper understanding of where consumers bank. National banks led the way (48%), with credit unions as the close second (33%). We know younger generations are less likely to be loyal to just one financial institution. Our report supports this data where out of the 48% that use a National Bank, 25% also bank with a credit union. Consumers are more willing to use different institutions to meet specific needs, and there are fewer barriers to leaving if those meets aren't met - highlighting the need for solid customer experiences across every service level.

When we started digging into bill payment preferences, only 19% of respondents said they use pre-authorized payments. With pre-authorized bill payments, consumers must stay on top of their account balances to avoid overdraft fees. However, the problem with other methods is that they depend entirely on the consumers' ability to stay organized and pay on time (which, as we know from the rising delinquency rates in the U.S., can be challenging). One respondent commented:

"Paying bills is overwhelming. There's so much to keep track of."

Digging deeper into how consumers prefer to pay their bills, the majority prefer to pay their bills online, with 54% through the bank's website/app and 38% through the vendor's website/app. There's a clear preference for speed and flexibility, making it apparent that investing in easy-to-use digital platforms for bill payments is necessary.

Although email communication is becoming a business necessity, we're seeing a rise in the demand for text message bill payment reminders (49%). It's important to capitalize on both digital channels (email and text) as they each have their strengths for capturing attention.

Spotlight on Texting

More than a quick trend, text messaging deserved its own spotlight section within the report. Do you know, on average, how many times the average U.S. consumer looks at their phone every day?

It’s a shocking (yet unsurprising) number. If you’re not yet leveraging this channel for bill payment reminders, you're missing an opportunity to capture attention.

Incorporating texting as an additional reminder can complement other communication channels in a new, effective, and attention-grabbing way. If this service is on your future roadmap because you don’t have the infrastructure, working with a third-party vendor can help speed up adding this technology to your collection workflow.

If we go a step further with text messaging, what if consumers could engage in a two-way text conversation from the bill reminder message? It goes back to speed and convenience. Adding this capability to your service offering allows for a productive, real-time conversation with busy customers who can reply at their convenience.

Understanding Past-due Consumers

If you're new here (hi!), we often discuss the importance of an empathetic collections approach. That usually begins with gaining a better understanding of consumers' financial situations, why they may be late on a bill, and what could help get them back on track (or in some cases, they have the money but need more frequent reminders in their channel of choice).

There's a wide variety of reasons for being late on a bill, from forgetting, not having the money, being away from home without access to bills, having expired credit cards on file, etc. In reality, 60% of survey respondents have been late on a bill. This is where the right cadence of reminders, coupled with a digital-first communication strategy that is easy to scale, can help consumers who have the money but are late to make a payment. On the flip side, for those who don't have the money and need some help, offering payment plans and arrangements can help them get back on track.

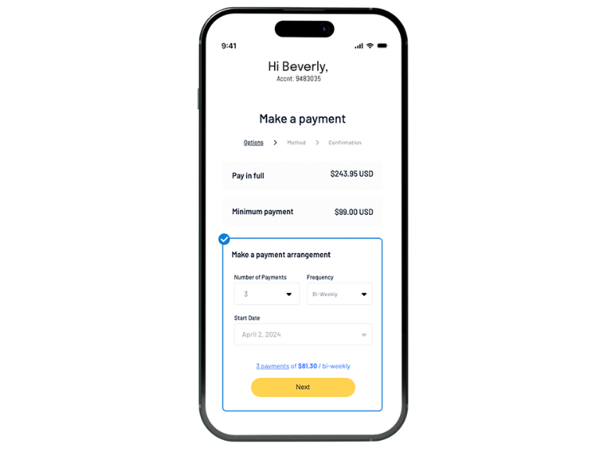

Payment arrangements are still the missing piece for many financial institutions since 30% of respondents said no payment options were offered. Payment arrangements are often difficult for financial institutions to execute unless facilitated over the phone (and we know from our findings that fewer and fewer consumers want to call in. Providing tools that allow for paying partial bills in a self-service experience can make the process less embarrassing for customers and easier for agents to manage.

.png?width=768&height=300&name=Payment%20Arrangements%20(2).png)

More importantly, 63% of respondents said a no-fee payment plan would help them get back on track. Incorporating digital tools that allow for flexible payments within set limits that you can manage is an effective customer-focused collections strategy.

On the topic of fees, there are conflicted feelings toward late bill service fees, from understanding (32%) to anger (25%). Although these service fees are a great way to help cash flow and incentivize consumers to pay on time, late fees may affect the customer relationship, as some view them as a sign of inflexibility and lack of empathy. One respondent wrote:

"They already know that I’m struggling and if I'm behind or late it's usually because I don't have the money, so they are just putting me more in a hole when they charge a fee."

What Consumers Want in Digital Banking Services

Finally, in the last section of the report, we get into the impact and importance of digital services and how it ties into loyalty and retention.

We touched on this earlier, but 39% say they would consider making the switch, and 18% would definitely switch to a different bank if their digital services were better. Within the report, our findings also highlight how younger generations are quicker to make the switch. Recognizing younger generations' preference for digital services and offering convenient self-serve tools is crucial for attracting and retaining them, which supports membership growth.

While we know that digital services help with retention, what type of services do they value the most?

Consumers value easy and user-friendly online banking experiences the most. They crave features that improve and speed up their banking, ultimately making their lives easier.

Financial institutions must prioritize investing in tools that align with consumer needs and expectations to remain competitive and attract new customers.

Consumers want flexibility, payment options, transparency, frequent reminders, and a variety of convenient digital services. The financial institutions that can deliver this experience across every service level, from origination to collections, will benefit from happier, more loyal customers.

By keeping pace with consumer preferences, needs, and frustrations, financial institutions can enhance both the repayment experience and overall customer satisfaction while at the same time improving collection efforts and recovery rates.

Download the 2024 “Clicks, Taps, and Texts: Decoding Consumer Preferences in Digital Banking and Bill Payments Report”

We’ve only scratched the surface in this blog. Download the full report here.

.png?width=575&name=Consumer%20Survey%20Blog%20Header%20(1).png)

.png?width=768&height=352&name=Text%20Message%20Effectiveness%20Graphic%20Blog%20(1).png)

.png?width=768&height=300&name=Two%20way%20texting%20survey%20image%20(3).png)

.png?width=768&height=300&name=Digital%20Services%20Graph%20(1).png)