Recovery in the current financial climate has proven to be a difficult task. When deferrals and financial support, including the CERB, came to an end in September, consumers had several unpaid bills. Even with newly announced government financial assistance programs, they have been left with little options to pay their past-due accounts.

Now, the second wave is upon us, and restrictions are being reimposed, wearing people down mentally. Every human being on the planet has been affected by the pandemic in some form or another, so It can be easy to forget that some have been hit harder than others. Compassion and flexibility need to play a vital role in helping consumers through these difficult financial situations.

Unpaid bills on the rise

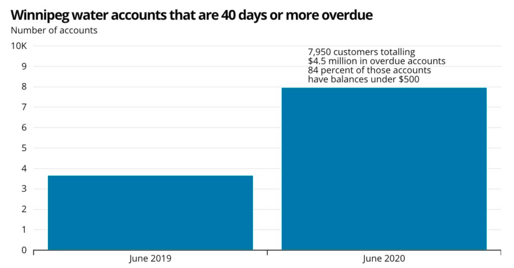

The Toronto Star recently reported that in Manitoba, there are tens of thousands of households who are behind on their utility bills this year, presenting a dilemma between asking past-due customers to pay up while showing compassion for their situation. The article also revealed that at least 75,557 Manitoba Hydro customers are past-due for their gas and electric bills, which amount to nearly $20 million in late payments this year. There has been a 118% increase in late water bill payments in the City of Winnipeg compared to last year. This amasses to around 8,000 households with overdue amounts of at least $4.5 million.

SOURCE: City of Winnipeg

SOURCE: City of Winnipeg

This data only represents one province's situation, so it's fair to presume that this issue is likely a common theme across Canada. Knowing this, how can your company encourage customers to make payments on their past-due accounts if they're in a difficult financial position, and show them you understand their situation and are willing to work with them to settle their accounts?

Below we outline some suggestions on how to maneuver the situation so the customer experience doesn't suffer.

Emphasize flexible payment options

This is the time to emphasize flexible payment options. Customers now more than ever need help putting plans in place to take care of their past-due amounts. Giving them opportunities to make payment arrangements or minimum payments can be critical to empathize with them and ensure the customer experience does not suffer.

Multiple past-due payment reminders

If the issue is getting your customer's attention, you can send multiple past-due account reminders and tailor the messaging accordingly to fit each unique situation. You can outline the importance of making payments while including messaging that shows them you understand the problem and want to work with them to resolve it. You can also track each of these payment reminders sent to ensure proof of delivery.

In-house collections software solutions can speed up recovery

The process of contacting past-due customers in the traditional way can be time-consuming. By mail, you have no control over how long it takes to reach them, and by phone, it may take several weeks to get a hold of them to have an actual conversation. Automated collection software eliminates these barriers. The software can send out thousands of email and SMS reminders to them so they can be made aware of past-due amounts or shown there are flexible payment options. The benefit of automation lies in the sheer volume of customers you can reach fast so that they can make a payment arrangement online in mere seconds.